Tired of managing all your DeFi positions?

Managing your DeFi risks should be intuitive and simple.

Your DeFi Positions Now

Fragmented Management

Juggling multiple wallets for different strategies.

Manual Work

Claiming rewards, repaying loans, and rebalancing takes hours.

Risk Spillover

One failed strategy risks your entire portfolio.

VaultFolio Solutions

Isolated Vaults

Separate strategies by risk level (e.g., "Safe Staking" vs. "High-Yield ETH")

Auto-Pilot Yield

Let your earnings repay loans, reinvest, or auto-buy assets automatically.

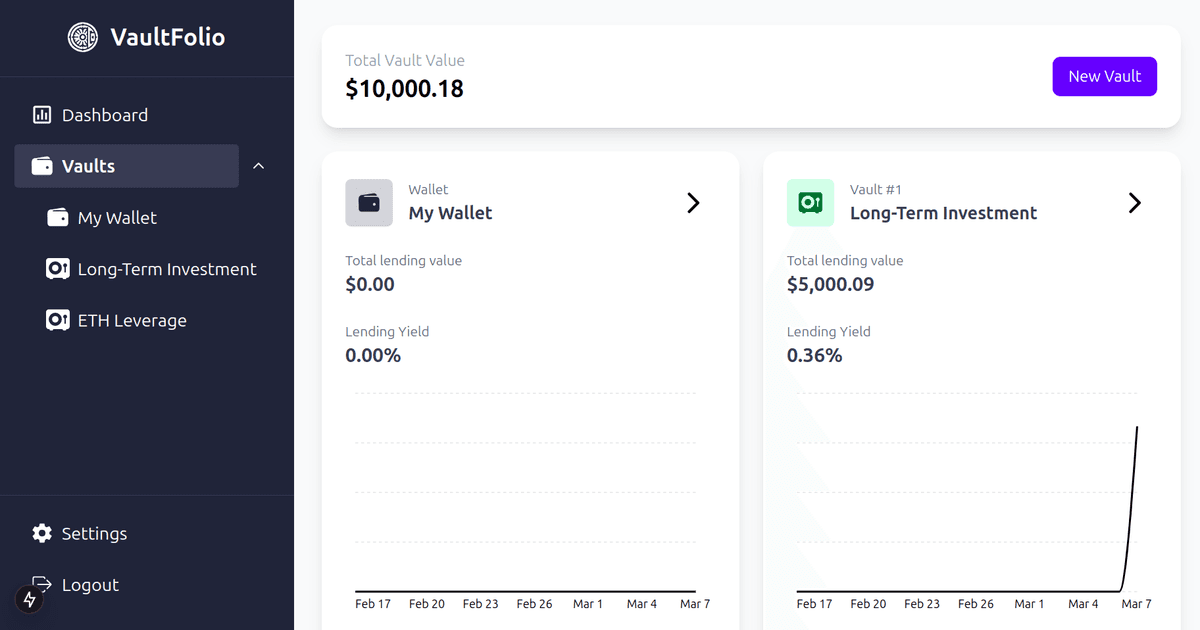

Unified Dashboard

Monitor, adjust, and optimize—all in one place.

DeFi Strategy Simplified

Compartmentalize risks, automate workflows, and scale your crypto strategies—all from one dashboard.

Keep Your DeFi Moves Separate & Safe

Create isolated vaults to silo your DeFi strategies. Keep your safe staking separate from your risky plays. No more domino effects if one goes sideways.

Deposit, Borrow, Earn—Risk-Adjusted

Provide liquidity, borrow against assets, or loop yields—all within a single vault. One strategy’s risk stays locked away from the rest.

Set It and Forget It

Turn yield into auto-repayments, DCA buys, or compounding loops. Your vault works while you sleep.

DeFi Management Reinvented

We're redefining DeFi management through user-centric design.

Unified Interface

No more juggling 10 wallets or manual micromanagement. Manage all your DeFi strategies in one secure interface.

Isolated Strategies

Create dedicated vaults for specific strategies as “Stablecoin Lending“ or “Leveraged ETH” and isolate your risks.

Custom Rules

Customize rules for every vault. Automatically reinvest 20% of yield into BTC or use 50% of rewards to repay loans—it's all under your control.

Optimize Fees

Enjoy minimal fees and fast transactions. Even small strategies benefit when high gas costs are a thing of the past.

DeFi ManagementSimplified

Focus on your strategy, not wallet management. Get started in under 2 minutes.